Go-To-Market Strategy: What Startup Founders Can Learn From the NFT Craze

It's been another wild week for non-fungible tokens (NFTs) and the crypto market:

Dapper Labs Inc, the company behind the popular NBA Top Shot platform, raised $250 million in its latest funding, valuing the company at $7.6 billion

Soccer-focused NFT platform Sorare raised a $680 million Series B round, which values the company at $4.3 billion

All cryptocurrency-related transactions are now illegal in China

Twitter says it’s planning to “soon” explore support for NFT authentication

To some, the NFT craze is just another bubble “some kids trading jpegs.” Others believe it’s the early transition to the next stage of the web evolution (web3) that will disrupt the way content creators distribute and monetize their content. While that’s an interesting debate, it's not what I will discuss in this post.

Instead, I've spent some time trying to understand the tactics NFT projects use to gain traction. Like early-stage startups, they also have limited resources with core teams ranging from 1 to 5 people. What surprised me is that most projects use a similar approach in their marketing, and I think there's a lot to learn from it. Could their go-to-market strategy become a new playbook for more traditional startups?

Let’s dive in!

Roadmaps: the new pitch decks

Most NFT projects raise money directly from users through the minting process, the act of publishing artwork on the blockchain, and issuing a token to guarantee its authenticity. To motivate people to mint their artworks, NFT projects often publish a roadmap (or whitepaper) to describe future product developments.

Many projects promise the moon to get people to invest, but most of them can't deliver. On the other hand, successful projects tend to present more realistic goals.

So what can traditional startups learn from this?

Product roadmaps are often just one of several slides that startups use to pitch their ideas to potential investors. But making these roadmaps available to the public can help startups to:

Create excitement and set the right expectations with early adopters

Motivate early adopters to spread the word (to unlock new milestones)

Gather product feedback before launch instead of post-launch

More and more companies are now “building in public.” Here are some examples of public roadmaps for inspiration: Github, Front, or Buffer. While those are great, I suggest going further and include an illustrated version directly on your homepage.

Community-led growth

In my opinion, the most impressive thing about NFTs is their communities. This tweet below summarizes well the growth loop behind every successful NFT project.

NFT projects are able to bootstrap early demand without spending any money on marketing because owners are directly incentivized to spread the word to others. The more they talk about their NFTs, the more likely their value will increase.

Limited supply → increasing demand → prices go up

In short, community-led growth is about turning your followers into leaders. The Loot project is probably one of the best examples of a community-led initiative.

Because the public could interpret it in any way they wanted, many people found a home for it. After a month, it has been converted into hundreds of projects, from games to songs. For those looking to buy, the cheapest one on sale as of this writing goes for $18,639! Yes, for a jpeg with random words on a black background :)

For traditional startups, community-led growth is the new grail (read buzzword):

But while the concept of community is simple.

A tribe is a group of people connected to one another, connected to a leader, and connected to an idea. For millions of years, human beings have been part of one tribe or another. A group needs only two things to be a tribe: a shared interest and a way to communicate.

— Seth Godin, Tribes: We Need You to Lead Us (2008)

Very few startups manage to align incentives/interests, and even fewer dare to let their community self-organize. One of the few successes that come to mind is Notion:

Brand universe

Today, there are 20,378,228 NFTs on sale on OpenSea (the leading secondary market for NFTs) for 216K active users. For new projects, it’s stand out or die trying.

A great example of a project that stood out is BAYC (Bored Ape Yacht Club).

In an interview for the New Yorker, the BAYC creators describe how they thought about differentiation early on:

Both of those projects (CryptoPunks and Hashmasks) were closed systems; their developers didn’t promise any expansion beyond the initial, limited release. We were seeing the opportunities to make something with a larger story arc. Avatar projects up to that point tended to employ low-resolution, often pixelated imagery, in the style of eight-bit video games. Bored Ape Yacht Club, by comparison, created rich and detailed iconography. Why apes? In crypto parlance, buying into a new currency or N.F.T. with abandon, risking a significant amount of money, is called “aping in”. (…) To execute the project’s graphics, they hired professional illustrators, which accounted for most of their upfront costs (around forty thousand dollars).

To stand out, the BAYC creators borrowed from the Disney recipe and created a rich and culturally relevant universe around their avatars. While I wouldn’t advise a startup to spend $40K upfront on branding, it can’t be an afterthought. In a crowded global marketplace, positioning matters more than ever.

So what would this map look like for your startup? And what’s your brand IP?

Early adopter rewards

A common practice in crypto and NFT is airdrops. In simple terms, it’s like gifting.

The main difference with most gifts is that their value can increase significantly over time. For example, the creators of BAYC gifted early members a dog NFT (Bored Ape Kennel Club). This “cute gift” turned out to be quite lucrative. A bundle of 101 Bored Ape Kennel Club NFTs recently sold for $1.8 million!

Gifting is also a common practice among traditional startups, but these gifts have generally low perceived (and depreciating) value like branded swag and stickers.

If you want to rally early users, don't give them an item that will quickly lose its value.

A few ideas:

Lifetime deals at discounted prices for subscription-based startups

Limited edition products for DTC brands

Premium placements for X weeks/months for marketplaces

A sense of ownership with exclusive access

Loyalty incentives #hodl

Retention is the single most important thing for growth. Yet, most startups create more incentives for new users (discount and trial offer…) than for existing ones.

To solve this issue, NBA Top Shot came up with an innovative solution:

Collector Score is a game-changing feature for the NBA Top Shot experience. As packs remain in extremely high demand, Collector Score has become the most reliable mechanic to ensure our most active collectors have access to the most exclusive pack drops, while incentivizing newer collectors to grow their collections as a path to gaining access to exclusive pack drops.

Access to new products isn’t only on a first-come, first-served basis but also weighted based on the customers’ previous platform usage.

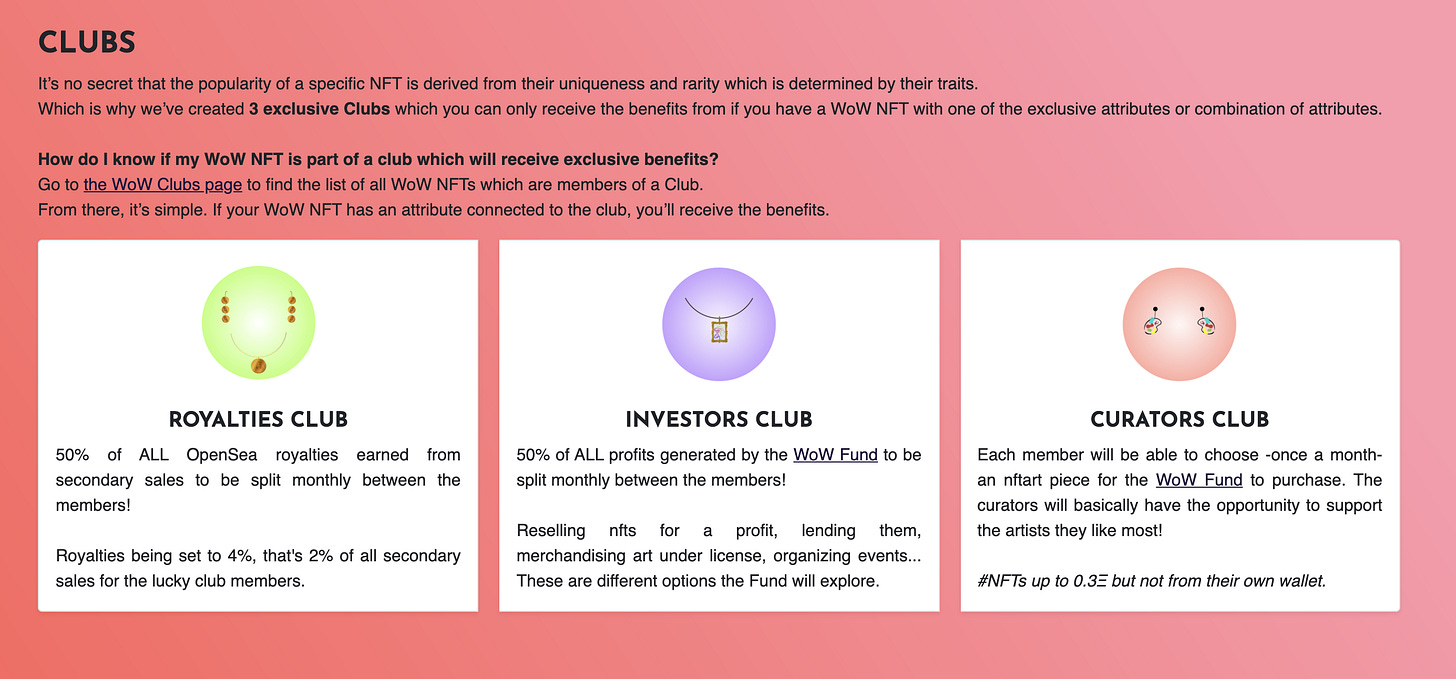

Other projects like World of Women incentivize simultaneously new and existing users with benefits attached to specific NFTs: some providing royalties on future transactions and others giving exclusive access to new collections.

Loyalty programs are nothing new but “stay to earn” dynamics are. The closest thing I can think about coming from a traditional startup is when Airbnb set aside 7% of their IPO shares to hosts. As customer acquisition costs keep climbing, more startups will explore creative ways like this to reward their most valuable customers.

Customer obsession

This CNBC interview from 1999 shows that Jeff Bezos wasn’t trying to build just another Internet startup but leverage what the Internet had to offer to provide a better customer experience.

The web is still an infant technology. Basically, right now, if you can do things using the more traditional method, you probably should do them using the more traditional method. It doesn’t matter to me whether we’re a pure Internet play. What matters to me is do we provide the best customer service. Internet shminternet, you know, that doesn’t matter.

Like Amazon did with the Internet, the most successful NFT projects do not focus on technology in a vacuum but on their customers’ needs. For example, Sorare never mentions NFTs on their homepage and allows users to checkout with more traditional payment methods than cryptocurrencies. They built a customer experience that removes frictions and jargon focusing on what users are already familiar with.

A common mistake for startups is to brag about the technology powering their products, whether it’s machine learning, blockchain, or others. But it’s often at the expense of the customer experience. So keep it simple!

Takeaways

Studying how the most successful NFT projects go to market and gain traction shown me that there was nothing magical or groundbreaking about their marketing.

They leverage tactics that have been around for a long time and that can apply to more traditional startups too. Here are five key takeaways:

Be transparent about future product updates for fast feedback loops

Align interests with your community and trust them to deliver the message

Be strategic about positioning and branding early on

Reward your true fans (early and most active users) with appreciative benefits

Obsess over customer experience to remove unnecessary frictions

If you’re in the process of going to market, I hope that this post was valuable. If you have any questions or need help with anything, feel free to reach out 👋

Until next time,

PS: A good NFT-related meme for the road